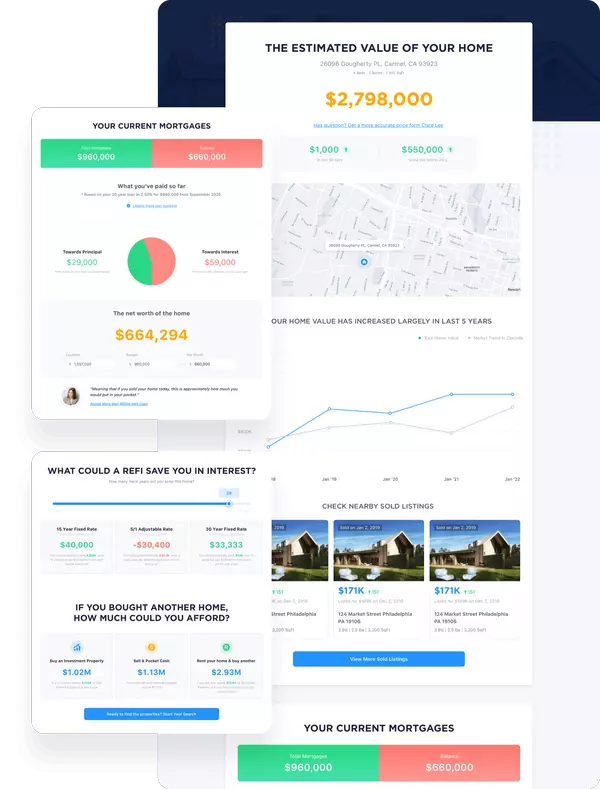

Home Appraisal Calculator

Elite Icon Team's home appraisal calculator is a digital tool that leverages a combination of data inputs and algorithms to estimate the current market value of a property. This tool is used by homeowners looking to sell, buyers looking to make informed purchasing decisions, and lenders evaluating a property for mortgage purposes. The calculations it performs are based on a range of factors that collectively contribute to the overall value of a home.

House Appraisal Estimate

The house appraisal estimate generated by our calculator can be very helpful in establishing an initial baseline from which to plan your home-selling plan. To better understand the house appraisal estimate, it's essential to delve into the key components that the calculator takes into consideration.

- Location: One of the primary factors influencing a house's value is its location. Proximity to amenities, quality of schools, crime rates, and neighborhood trends all play a significant role in determining how desirable a location is. A property situated in a sought-after neighborhood is likely to receive a higher appraisal than one in an area perceived to be less desirable.

- Size and Layout: Larger homes generally command higher prices, but a home's layout is also crucial in determining its value. A well-designed and functional layout can positively impact the appraisal, while an awkward or outdated layout may have a negative effect.

- Condition of the Property: A well-maintained home with updated features and minimal repair needs is likely to receive a higher valuation. On the other hand, a property requiring extensive repairs or renovations may see a decrease in its appraised value.

- Comparable Sales (Comps): Appraisers often look at recent sales of similar properties in the same neighborhood to gauge the value of the subject property. These comparable sales, or "comps", provide valuable insights into the current market conditions and help establish a benchmark for the appraisal.

- Market Trends: Real estate markets are dynamic, and understanding current trends is crucial for an accurate appraisal. Factors such as supply and demand, interest rates, and economic conditions can all impact the market and, consequently, the value of a home.

Determine Home Value

The initial appraisal generated by our calculator is ultimately just a first step in determing your home's value on the market. Several other factors go into determining the optimal listing price for your property.

- Home Improvements: Buyers typically prefer move-in ready, updated homes. Renovations, outstanding repairs, and energy-efficient upgrades are examples of improvements that can contribute to a higher valuation. It's essential to keep detailed records of these improvements to provide accurate information to potential buyers.

- Local Market Conditions: The broader economic conditions and the local real estate market can also affect a property's value. In a seller's market, where demand outweighs supply, homes may be valued more highly, whereas the reverse occurs in a buyer's market.

- Unique Features: Special features or amenities that set a property apart from others in the area can influence its value and are best evaluated in-person. These could include a stunning view, a well-landscaped garden, or high-end finishes. These unique elements contribute to the property's overall appeal and can justify a higher selling price.